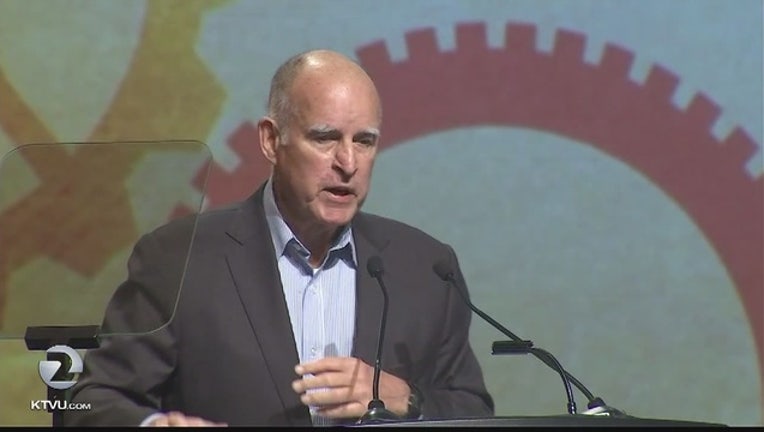

California governor: More spending for schools, child care

SACRAMENTO, Calif. (AP) - California Gov. Jerry Brown sought more spending on schools and child care Thursday as he revised his spending plan for the fiscal year that starts in July.

He cited a "modestly improved fiscal outlook" since January for allowing $1.5 billion more in general fund spending in his $124 billion proposal, despite uncertainty about future federal spending by the Trump administration as it seeks to overhaul the health care plan.

"We're trying as much as possible to keep us on an even keel," Brown said in proposing $1.4 billion more for K-12 schools and community colleges. By law, about half the state's spending goes to K-12 education and higher education.

He's also wants to reverse a proposed $500 million cut for low-income childcare that he sought in January. His budget also would cancel his proposal to shift $600 million in costs to counties, which supervisors warned their budgets could not absorb.

The release of Brown's spending plan kicks off a month of negotiations with the Democrat-controlled Legislature. His plan would need the approval of lawmakers.

"Spending has gone up far more than anybody ever imagined," Brown said, citing a tax increase and improving economy. Yet he warned again that the economy could tank, taking the state's budget with it and forcing sharp cuts in future years if lawmakers overspend now.

"What we're doing is fighting as hard as we can so that never happens," he said.

Democratic legislative leaders gave a tepid response to Brown's initial budget plan in January, rejecting Brown's proposed cuts to college scholarships and child care providers while insisting they would push to increase spending on social welfare programs.

Brown in January proposed a $122.5 billion budget that kept general fund spending mostly flat. The Democratic governor called for more than $3 billion in cuts because of a projected deficit he pegged at $1.6 billion. His administration later acknowledged it miscalculated health care costs.

His less-dire budget now cites increased revenue based primarily on higher capital gains.

Assembly Minority Leader Chad Mayes, R-Yucca Valley, called Brown's latest budget "a bait and switch," citing voters' approval last year of tax increases that he said were to fund health and dental care and support schools. Brown's budget siphons that money to general state spending instead, Mayes said.

"There will always be budget challenges, but we cannot let it stop us from improving the lives of ordinary Californians," Mayes said in a statement.

The ranking Republican on the Assembly Budget Committee, Jay Obernolte of Hesperia, was kinder, saying the revised budget makes some responsible choices based on the state's fiscal uncertainty. He praised Brown's plan to pay down part of the $200 billion of unfunded pension health care liabilities.

But like Mayes, Obernolte criticized the budget's "broken promises" to voters who approved tobacco tax and income increases last year.

Brown proposes to use much of the tobacco tax increase to cover normal growth in Medi-Cal, a publicly funded health plan that covers 1 in 3 Californians. The initiative had been promoted by doctors, dentists and others who thought the money would be used to increase their payments, which are significantly lower than private insurance.

The budget negotiations come as the U.S. Congress considers repealing former President Barack Obama's health care law, which California embraced to add nearly 4 million people to Medi-Cal. Administration officials say under a bill passed by the House last week federal funding for Medi-Cal would fall by $6 billion in 2020 and by $24 billion by 2027.

Brown said state spending already has increased significantly for education and social services in recent years and he doesn't believe the state can afford significant further increases.

"The reason's very simple. We've got ongoing pressures from Washington, and the economic recovery is not going to last forever," Brown said.

Tax collections have slowed since the governor's previous spending plan. Revenue in April - the most important month for tax collections because of the deadline for filing personal income taxes - fell far short of expectations. As a result, revenue for the first 10 months of this fiscal year fell short by $136 million.

The Legislature has until June 15 to approve a budget for the fiscal year starting July 1.