Refinancing your student loans can save you $250+ per month: Here's how

Student loan borrowers who refinanced to a longer term on Credible were able to lower their monthly payments by $253 on average. Use a student loan calculator to see how much you can save. (iStock)

Your monthly student loan payment can hold you back from achieving financial milestones like paying off credit card debt or even buying a home. Fortunately, it may be possible to lower your monthly payment by refinancing, thanks to low interest rates.

Student loan refinancing rates are hovering near all-time lows. During the week of July 5, rates on 10-year fixed-rate loans averaged 3.65% among borrowers with a 720 credit score or higher who refinanced their student loans on Credible. That's down from 4.32% just one year ago.

Rates averaged 3.05% on 5-year variable-rate loans, which is among the lowest they've been in all of 2021.

Keep in mind that it's not recommended that you refinance federal student loans right now, since doing so would make you ineligible for federal loan protections like student loan forgiveness and income-driven repayment. But if you have private student loans, now is the time to take advantage of lower interest rates to save money on your monthly payment.

See how much you can save on your student loans in the analysis below. When you're ready to start shopping for student loan interest rates, visit Credible to compare offers from multiple lenders without impacting your credit score.

WILL BIDEN EXTEND STUDENT LOAN FORBEARANCE AGAIN? HERE'S WHAT WE KNOW

Here's how real student loan borrowers reduced their monthly payments by $250+

Real-life borrowers were able to reduce their monthly student loan payments significantly by refinancing through the Credible marketplace, according to an analysis that took place from Nov. 1, 2019 to Dec. 1, 2020.

By extending their loan terms by 53 months on average, borrowers were able to reduce their loan payment by $253 per month, the study found. The sample had an average loan amount of $70,163 and reduced their annual percentage rate (APR) by 2.05%.

If you want to refinance your private loans in order to decrease your monthly payment, it's important to shop around for the lowest interest rate possible for your situation. You can compare rates across multiple student loan refinancing lenders by filling out a single form on Credible.

COVID-19 HAS AFFECTED THE COST OF COLLEGE: HERE’S WHAT’S CHANGED

Use a student loan calculator to see how much you can save

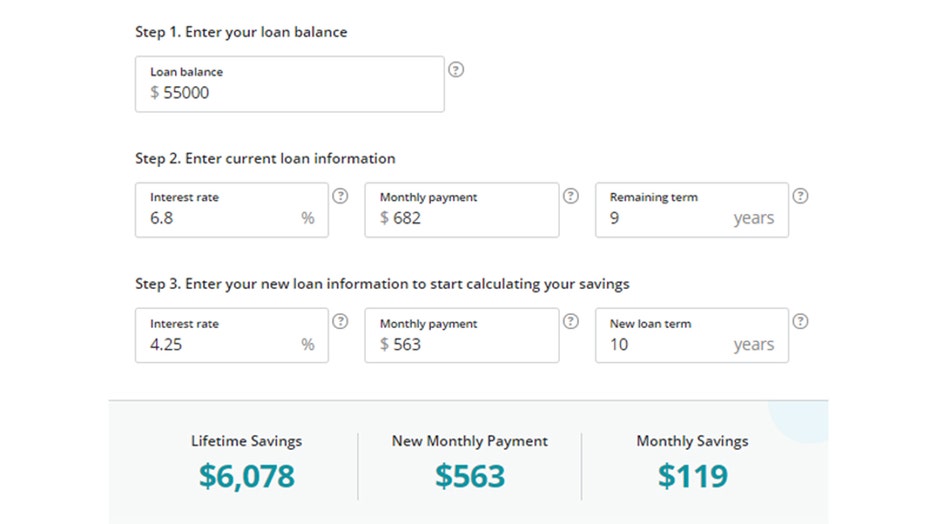

It's easy to see how much you can save on your monthly payment by using a student loan calculator, like this one from Credible. If you're on the fence about whether or not to refinance your student loans, it's helpful to estimate your new loan terms. Here's how:

- Gather your loan documents. You'll want to know the remaining amount of your loan and the amount of time you have left to pay it off, as well as your monthly payment amount and interest rate.

- Estimate your new interest rate. You can see what kind of student loan rate you might be eligible without affecting your credit score on Credible.

- Enter your information in the calculator. Credible's student loan refinance calculator will show you your new repayment terms, including your monthly savings and total interest paid.

Still not sure if refinancing is the right move for you? Reach out to a loan officer at Credible to discuss your options to decide the best way to pay off your student loans.

PARENT PLUS LOANS: WHO QUALIFIES AND HOW TO REFINANCE THEM

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.